Loading...

A Guide to the AfDB's Independent Recourse Mechanism (IRM)

If the African Development Bank Group (AfDB Group) funded or supported the project that is causing you harm, you may be able to file a complaint with their accountability mechanism, the Independent Recourse Mechanism (IRM).

What is the AfDB Group?

The African Development Bank Group (AfDB Group), established in 1964, is a regional multilateral development bank headquartered in Abidjan, Côte d’Ivoire, that provides financing to both the public and private sector across the African continent. The AfDB Group is made up of constituent institutions, including: the African Development Bank (AfDB), the African Development Fund (ADF), and the Nigeria Trust Fund (NTF).

The African Development Bank (AfDB) is the main arm of the AfDB Group. It was established in 1964 to provide loans to governments in middle countries, and different types of financial assistance to private companies investing in Africa. The AfDB’s interest rates are similar to those of commercial banks, with loans having to be paid back within 5 - 20 years. The AfDB’s stated objective is to foster sustainable economic growth and social progress, and reduce poverty in Africa.

The African Development Fund (ADF) is a concessional financing institution of the AfDB Group that offers interest-free funding and grants that don’t have to be paid back for public and private projects and programs in low-income African countries.

The Nigeria Trust Fund (NTF) is a self-maintained revolving fund which acts as a concessional arm, assisting the least developed African countries. The NTF only allocates resources to projects, not countries.

What is the IRM?

The AfDB Group has an independent accountability mechanism: the Independent Recourse Mechanism (IRM) (previously known as the Independent Review Mechanism until 2021). The IRM was established in 2004, and receives complaints related to the environmental and social impacts of AfDB Group supported projects. If you are affected by an AfDB group-supported project, you can file a complaint with the IRM.

To file a complaint, you need to provide specific information about the issue you are experiencing, as outlined in the “How to file a complaint” section below.

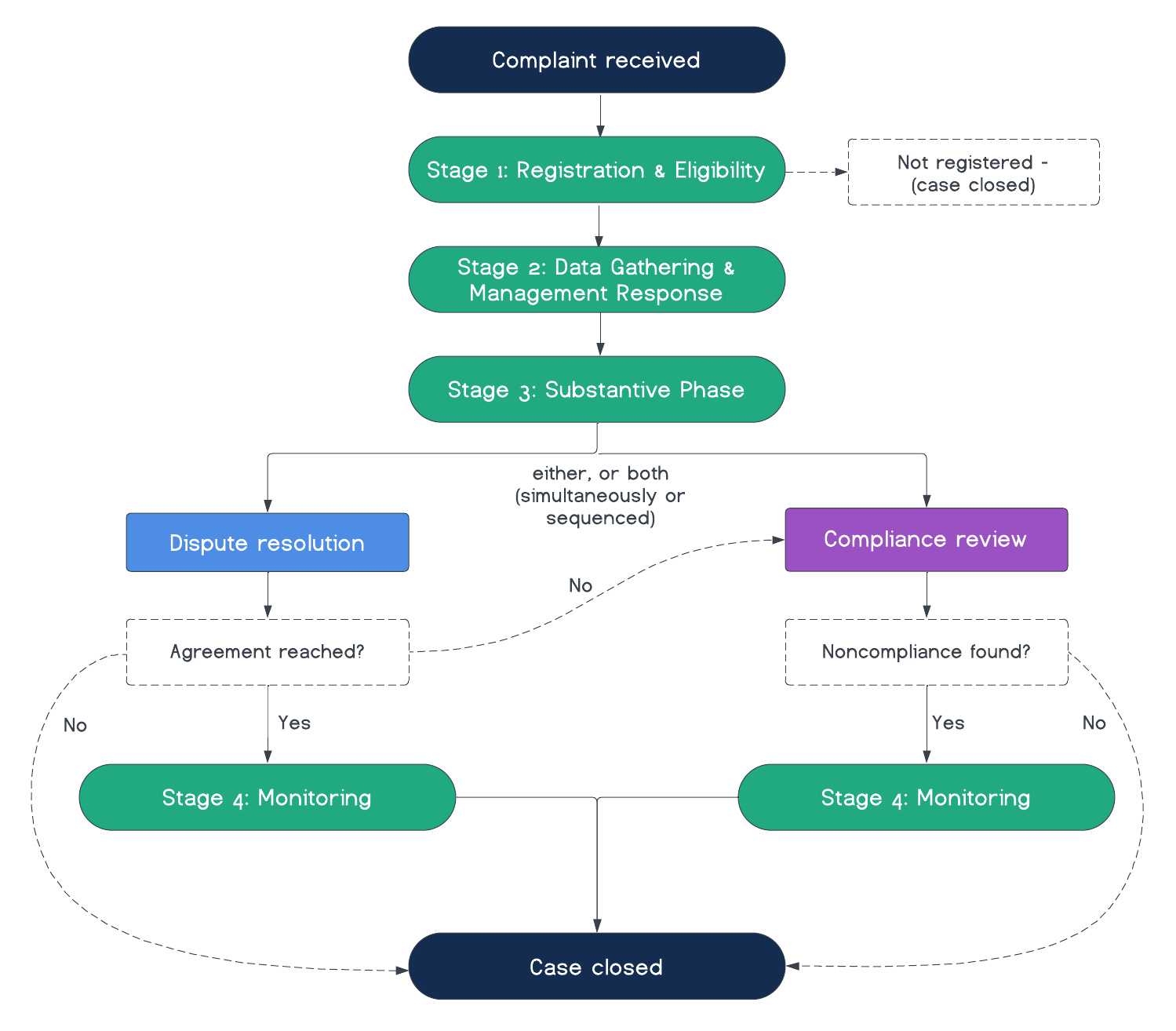

If your complaint is found to be eligible, the IRM has two functions to try to resolve the complaint: dispute resolution (also known as problem-solving) or compliance review. You can decide which process you would like your complaint to enter if found eligible. If you want to try both problem-solving and compliance review, you can choose which to do first, or do them both simultaneously. You can learn more about the difference between problem-solving and compliance review, and which option is better for your complaint on the home page.

Dispute Resolution

At the IRM, the voluntary dispute resolution process is called “problem-solving”. During the problem-solving phase, the IRM team will facilitate dialogue and negotiations between the affected communities and the AfDB Group’s client with the goal of reaching a mutually agreeable solution. You can learn more about this phase below.

Compliance Review

At the IRM, the fact-finding investigation process is called “compliance review”. During the compliance review phase, the IRM investigates whether the AfDB Group has complied with their environmental and social policies, and whether any non-compliance has caused harm to the community. The IRM then prepares a compliance report that includes its findings and recommendations for the AfDB Group. You can learn more about this phase below.

Can you complain to the IRM?

Before filing a complaint, ask yourself the following questions. If your answer is yes to all of the questions, then you can complain to the IRM.

The IRM accepts complaints about all AfDB Group projects (including those financed by financial intermediaries) from when the project is under consideration by management until:

- up to 24 months after the physical completion of the project, or

- up to 24 months after the date the complainant became aware of the adverse impacts,

whichever comes later. You may be able to find information about project completion on the relevant project page on the AfDB website, by making an access to information request, or by reaching out to the IRM directly to ask for help.

Important: Your complaint cannot be anonymous, but you can request confidentiality regarding your identity or other information you submit to IRM. If you are facing reprisals or fear retaliation be sure to tell the IRM to discuss how you can move forward to address the risk of reprisals.

Duly appointed representatives can represent affected communities.

Any material negative environmental and social effect on people or the environment resulting directly or indirectly from an AfDB Group supported project. Harm may be actual or reasonably likely to occur in the future.

If you don’t fear retaliation, you are required to contact the AfDB Group Office in your country, headquarters, or the company, to let them know about the problem and give them an opportunity to address it before contacting IRM. When filing a complaint, submit a description of any good faith communication you had with bank staff. Keep copies of all communications (even if they are unanswered), and notes from all meetings, with Management to submit with your description.

Important: If you are facing reprisals or fear retaliation, you can skip this step and go directly to the IRM. Tell them why you did not contact the AfDB Group Office, if you would like them to keep your identity confidential, and discuss how you can move forward to address the risk of reprisals.

Model complaint letter

Complaint filing checklist

Download checklistStrengthen your complaint by referencing AfDB Group policies

When filing your complaint to the IRM, you may want to reference bank policies that were violated. Environmental and social safeguard policies play an important role in your complaint. These safeguards are rules and policies designed to identify and mitigate risks associated with bank activities, with an overarching goal of preventing environmental and social harms. Understanding these safeguards is essential for anyone seeking to hold banks accountable for harms associated with their investments.

The IRM receives complaints related to all environmental, social and governance aspects of AfDB Group operations, such as the Disclosure and Access to Information Policy and the Integrated Safeguards System, which can be found below.

Including this information is optional.

AfDB Group Policies

The AfDB Group requires itself and its clients to comply with the following operational safeguards:

Operational Safeguard 1: Assessment and Management of Environmental and Social Risks and Impacts

This safeguard requires AfDB Group’s client (the borrower) to identify, assess and manage environmental and social risks associated with a project. It establishes a mitigation hierarchy, instructing borrowers to anticipate, avoid, minimize and mitigate risks and impacts to acceptable levels, and compensate for or offset significant residual impacts if necessary.

Show more Show lessOperational Safeguard 2: Labour and Working Conditions

This safeguard protects workers rights, prioritizing health and safety at work. It requires borrowers to ensure safe labor and working conditions, prohibits forced or child labor in bank-financed projects, and establishes a grievance mechanism for project workers, including sub-contracted workers.

Show more Show lessOperational Safeguard 3: Resource Efficiency and Pollution Prevention and Management

This safeguard outlines the requirements for resource efficiency and pollution prevention throughout the project life cycle, following good international industry practice. Borrowers must promote sustainable resource use, minimize pollution, estimate greenhouse gas emissions where possible, and adhere to guidelines and standards.

Show more Show lessOperational Safeguard 4: Community Health, Safety and Security

This safeguard focuses on health, safety and security risks for project-affected communities. It emphasizes the borrower’s responsibility to minimize such risks, especially for vulnerable people. It also acknowledges that threats to human security may include reprisal risks.

Show more Show lessOperational Safeguard 5: Land Acquisition, Restrictions on Access to Land and Land Use, and Involuntary Resettlement

This safeguard aims to prevent forced displacement whenever possible or minimize its impact when unavoidable after exploring alternative project designs. It defines the types of involuntary displacement that can occur and outlines a process for developing a resettlement action plan to mitigate adverse impacts in projects with potential involuntary resettlement effects.

Show more Show lessOperational Safeguard 6: Habitat and Biodiversity Conservation and Sustainable Management of Living Natural Resources

This safeguard requires borrowers to safeguard biodiversity and habitats, employing a mitigation hierarchy and precautionary approach in project design and implementation. It also emphasizes supporting local communities, including indigenous peoples, and promoting inclusive economic development by integrating conservation needs with development priorities.

Show more Show lessOperational Safeguard 7: Vulnerable Groups

This safeguard instructs borrowers to identify vulnerable groups, particularly highly vulnerable rural minorities like indigenous people, early in the bank’s operations and engage with them in a meaningful way considering their specific needs. Projects impacting highly vulnerable rural minorities can only proceed with their free, prior and informed consent (FPIC). Ongoing dialogue and information sharing must be maintained throughout the project’s life cycle.

Show more Show lessOperational Safeguard 8: Cultural Heritage

This standard requires borrowers to safeguard cultural heritage from negative project impacts, promote its preservation, and consider it as a crucial aspect of sustainable development. It emphasizes meaningful stakeholder consultation and ensuring equitable sharing of benefits derived from cultural heritage use.

Show more Show lessOperational Safeguard 9: Financial Intermediaries

This safeguard notes that when the AfDB provides funds to a financial intermediary (who then on-lends those funds), that intermediary must have environmental and social systems in place, and create a management system for the project. It also requires the financial intermediary to engage with stakeholders, disclose the environmental and social management system on their website, and permit the AfDB to disclose it on their website.

Show more Show lessOperational Safeguard 10: Stakeholder Engagement and Information Disclosure

This safeguard aims to create a structured way to engage with stakeholders during the project cycle. Borrowers must identify all stakeholders, including vulnerable groups, provide clear and timely information, and conduct meaningful consultations free from manipulation or discrimination. A stakeholder engagement plan should be developed to inform and involve stakeholders in project risks and impacts, and offer a process to address grievances, including project grievance mechanisms and the IRM.

Show more Show lessFrom 2024 onwards, this policy is replaced with the Updated Integrated Safeguard System above.

Operational Safeguard 1: Environmental and social assessment

This safeguard encompasses the process for determining a project’s environmental and social category and establishing corresponding assessment needs. It covers aspects such as its scope, classification, employment of environmental and social assessments, management plans, climate change vulnerability assessment, public consultation, effects on communities, treatment of vulnerable groups, and grievance procedures.

Show more Show lessOperational Safeguard 2: Involuntary resettlement: land acquisition, population displacement and compensation

This safeguard summarizes the bank’s policy on involuntary resettlement while incorporating improvements for practical implementation. The safeguard requires providing compensation at full replacement cost, reiterating the importance of resettlement that improves standards of living, income-earning capacity and overall means of livelihood. It also emphasizes the need to avoid marginalization of project-affected people based on factors like gender and age.

Show more Show lessOperational Safeguard 3: Biodiversity, renewable resources and ecosystem services

This safeguard aims to conserve biological diversity and promote sustainable use of natural resources. The safeguard reflects the importance of biodiversity on the African continent, highlighting the importance of respecting, preserving and maintaining knowledge, innovations and practices of indigenous and local communities. Additionally, it protects and promotes the customary use of biological resources in line with conservation and sustainable use demands.

Show more Show lessOperational Safeguard 4: Pollution prevention and control, hazardous materials and resource efficiency

This safeguard addresses the impact of pollution, waste and hazardous materials. It introduces vulnerability analysis and greenhouse gas emission monitoring, while also outlining a framework for possible reduction or compensatory measures.

Show more Show lessOperational Safeguard 5: Labour conditions, health and safety

This safeguard establishes the requirements for borrowers of the bank concerning workers’ conditions, workers’ rights, and protection of workers from abuse or exploitation. It covers workers’ organizations, occupational health and safety, and avoidance of child or forced labor.

Show more Show lessAfDB Group has implemented a policy to ensure transparency and maximize access to information regarding its operations (with limited exceptions), and clear procedures for processing requests and reviewing decisions.

After submitting your complaint, the IRM will acknowledge receipt of the complaint. The IRM will then assess the complaint’s eligibility for registration. To be registered, your complaint must meet the outlined requirements in the “Can you complain to the IRM” section above.

A complaint will not be eligible, and therefore won’t be registered, if it is submitted more than 24 months after the physical completion of the project or more than 24 months from the date that you become aware of the adverse impacts, whichever occurs later. Complaints relating to procurement, fraud and corruption are also ineligible. Additionally, complaints will be deemed ineligible if they are fraudulent, frivolous or malicious, submitted anonymously, relate to matters already decided by the IRM with no new evidence, or concern the adequacy of Bank Group policies or procedures.

The IRM makes the final decision on eligibility. If your complaint is found to be eligible, it will be registered and appear on the Register. It can then progress to the substantive stage.

If your complaint is deemed ineligible, the IRM will not register your complaint, close the complaint file, and notify you of this decision.

If you haven’t provided enough information to the IRM, the complaint might be temporarily put on hold, also known as “temporary suspension” and you will be asked to provide further information. After a specified period of time, the IRM will make a decision as to whether to continue processing the complaint.

Once a complaint has been registered, the IRM will provide the bank’s management with a specified period of time to provide information on the complaint, including a description of the policies in question, the steps it has taken to ensure compliance with those policies, and the efforts it has made to resolve the issue. The IRM may also gather information during this time through site visits and additional research.

If you haven’t tried to solve the problem with the AfDB or the project’s grievance mechanism and don’t explain why to the IRM, the complaint might be temporarily suspended. The bank and project managers will be asked to try and fix the issues during this time. After a specified period of time, the IRM will, after consulting with the complainants, bank management, and/or the borrower/client, make a decision as to whether to continue the temporary suspension or continue the processing of the complaint.

All eligible complaints should then enter a substantive phase. As mentioned, at the IRM you have the option to choose either “dispute resolution” or “compliance” as the next step, or do both (simultaneously or sequenced).

Dispute Resolution

The dispute resolution phase consists of two steps:

Step 1: Problem-solving eligibility assessment:

The IRM conducts an assessment to decide if parties involved are willing to engage in the problem-solving process. In considering this, the IRM will assess whether parties agree to participate, negotiate in good faith, respect confidentiality, and whether they have the authority to settle the dispute. The IRM may visit the project site at this stage. A problem-solving assessment report is then prepared with recommendations on whether or not the complaint should be handled through problem-solving.

Step 2: Problem-solving exercise:

As mentioned above, “dispute resolution” (also known as problem-solving) is a voluntary process where the IRM acts as the facilitator between the community and the AfDB’s client. This process can involve dialogue, joint fact-finding, mediation, negotiation, and facilitation, and this process can and should be designed and implemented together. The aim of a dispute resolution is to reach an agreement between all the parties, and find a mutually agreeable solution to your concerns.

Since dispute resolution is voluntary, any party can choose not to participate. If at any stage of this process a party no longer wants to continue with dispute resolution, the case is transferred to compliance.

If parties agree to participate, communities can share their concerns about the project directly with the AfDB’s client, and advocate for specific solutions to their concerns. If the parties agree on solutions, the IRM will help them to formalize those solutions in a signed agreement. Upon completion of this phase, the IRM will prepare a report on the results of the dispute resolution. If the parties request confidentiality, the IRM will only publish a summary of the agreement on the Register.

If no agreement is reached (within a period of one year or if the parties agree to transfer), or if there remain issues that are not addressed by the agreement, the case may be transferred to compliance.

If you would like to know more about what a dispute resolution process involves, see the case study for the Marrakech-Agadir Motorway or IRM’s Operational Guidelines.

Compliance Review

The compliance phase consists of two steps:

Step 1: Compliance review eligibility assessment:

The IRM conducts an assessment to decide if an investigation is necessary. At this stage, the IRM’s focus is on whether there is clear evidence of environmental and/or social harm and if such harm can be linked to the bank’s failure in following its own policies. This stage is not a full investigation, but rather a preliminary assessment of whether there is prima facie evidence that justifies further investigation. The IRM may visit the project site at this stage.

The IRM will then release a compliance eligibility assessment report. If an investigation is warranted, the report will set out the scope and time frame of the compliance review.

Step 2: Compliance review:

As mentioned above, this is the compliance review phase, which is a fact-finding process where the IRM acts as the investigator to investigate whether the AfDB has complied with its environmental and social policies, and whether such non-compliance has caused harm to the community.

After investigating, the IRM prepares a compliance review report with its findings and recommendations. If the AfDB is found to be in compliance, the IRM will close the investigation. If the AfDB is found to be non-compliant, the IRM may recommend remedial changes to bank policies, redress for harm and institutional learning amongst other recommendations.

AfDB Management then has a specified period to respond to the report and indicate the actions they will take to address the concerns raised. The Board of Directors review and approve the compliance review report and the Management’s action plan.

If you would like to know more about what a compliance process involves, see the IRM’s Operational Guidelines.

If your complaint goes through a dispute resolution process and results in an agreement, or goes through a compliance review and an investigation report is published, then the complaint will enter a monitoring phase.

Dispute Resolution

If an agreement is reached, the IRM will help the parties by monitoring the implementation of the agreement. Monitoring can be achieved by setting a program, timelines and outcome indicators within the agreement. The IRM will monitor whether the agreement was implemented and publicly disclose the outcomes on IRM’s website. When a complaint is closed, the IRM will release a Conclusion Report.

Compliance Review

If the AfDB is found to be non-compliant, the IRM will monitor the situation until the management action plan is fully implemented. The monitoring reports will be submitted to the Board of Directors. The final monitoring report will conclude the compliance review process. The IRM will then close the complaint.

Comparison to best practice

Independence: The IRM’s reporting line is independent from bank management; it reports to the Board of Directors through the Board's Committee on Operations and Development Effectiveness (CODE).

Transparency: The IRM makes complaints, eligibility reports, final compliance reports, dispute resolution reports, and follow-up monitoring reports public.

Remedy: The IRM can make recommendations for remedial measures to address areas of non-compliance, and explicitly has a mandate to recommend remedy for communities.

A look at the data

We have brought together some charts, based on the latest data available in the Complaint Dashboard, to offer a deep dive into the AfDB and IRMs performance.

Complaint Outcomes

Eligibility

Dispute Resolution Outcomes

Compliance Review Findings

Complaint issues

Complaint sectors

Recommendations to improve IRM

Complainants should not be required to raise the issues in the complaint with AfDB management or the client before filing the complaint (GPP 32)

Currently, the IRM Director is allowed to have been employed by the AfDB in the past. To strengthen the IRM’s independence, former members of AfDB management and the Board should be barred from leading the IRM. (GPP 11)

The IRM should alert the Board when the MAP is not being adequately implemented and make recommendations for its improvement (GPP 59)

Independent Recourse Mechanism (IRM): https://irm.afdb.org/en

To send complaints:

irm@afdb.orgOnline complaint form:

https://irm.afdb.org/en/page/file-complaint/complaint-formBP 1387 Abidjan 01, Côte d’Ivoire - Immeuble du Centre de Commerce International d’Abidjan (CCIA) - Avenue Jean Paul II, 14th Floor

Date Last Updated: Jan. 4, 2026